Home Affordability Calculator

See how much home you can afford in different states. This tool accounts for state-specific factors like California's Proposition 13 property tax reset, insurance costs, and hidden fees.

Your Financial Details

Affordability Results

California-Specific Note: California's Proposition 13 property tax reset means your taxes will jump when you purchase a home. This calculator includes this effect for CA properties.

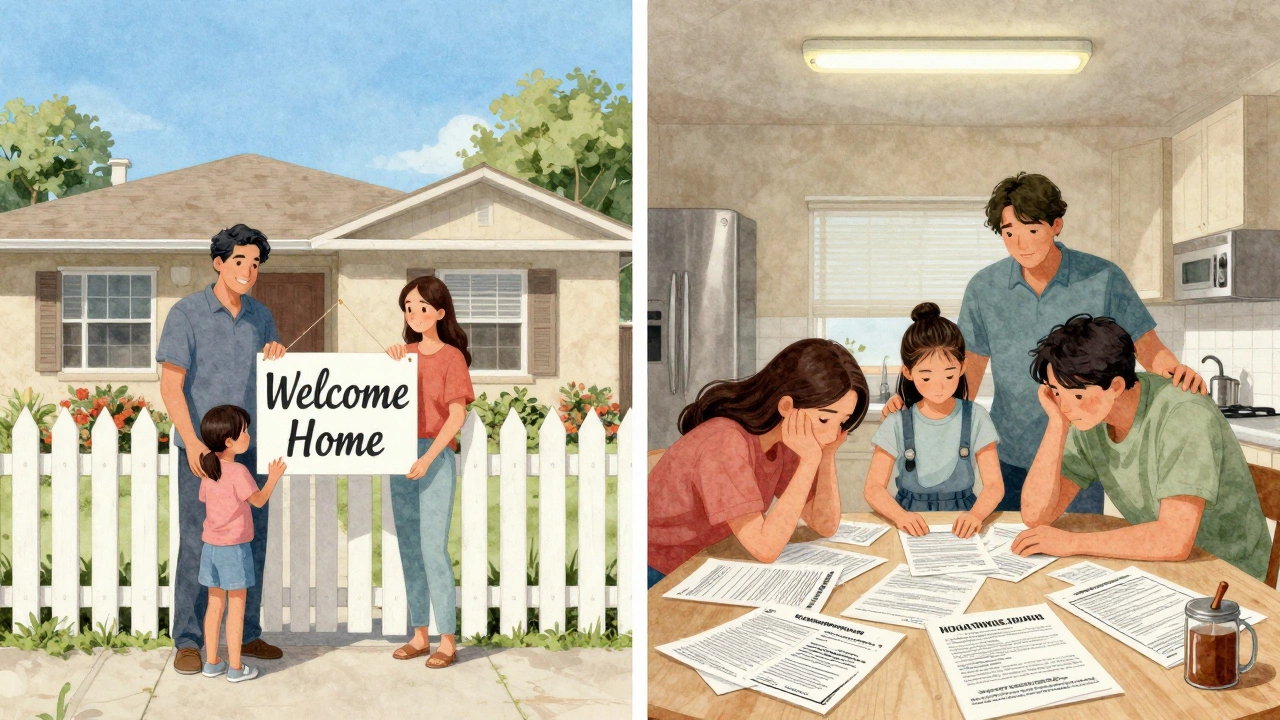

Buying a home isn’t just about finding a house with good light and a decent backyard. In some states, the entire process feels like climbing a mountain in a snowstorm with no map. If you’re thinking about moving or buying property online, you need to know where the real barriers are-not just in price, but in bureaucracy, supply, taxes, and sheer frustration.

The housing crisis isn’t evenly spread

California doesn’t have the highest median home price in the U.S. anymore. Hawaii does. But California still wins the title of most difficult state to live in for homebuyers-not because of the sticker price alone, but because of how every other factor stacks against you.

As of early 2026, the median home price in California is $812,000. That’s more than double the national median. But here’s what no one tells you: the average household income in California is $86,000. That means you’d need to earn nearly $120,000 just to qualify for a mortgage on a median-priced home, assuming zero debt and a 20% down payment. Most buyers don’t have that.

And even if you somehow scrape together the cash, you’re fighting a system designed to slow you down. Permitting for new construction takes 18 to 24 months in Los Angeles and San Francisco. Zoning laws in many cities ban anything taller than two stories. The state added just 120,000 housing units in 2025-while adding over 300,000 new residents. The gap isn’t narrowing. It’s widening.

It’s not just about price-it’s about paperwork

California’s environmental review laws, like CEQA (California Environmental Quality Act), sound noble. They’re meant to protect nature and communities. But in practice, they turn every new project into a legal battleground. A simple 12-unit apartment building in San Diego can take five years to get approved because of lawsuits from neighborhood groups, environmental impact studies, and mandatory public hearings.

Buyers don’t always see this. They think they’re just waiting for a closing date. But behind the scenes, developers are giving up. In 2025, over 40% of planned housing projects in California were canceled or scaled back because of regulatory delays. That means fewer homes, higher prices, and more competition.

And then there’s the property tax system. Proposition 13, passed in 1978, caps annual tax increases at 2%-but only for the original owner. When you buy a home, your property taxes reset to the full market value. So if you bought a $600,000 house in 2020, your taxes were $6,000 a year. In 2026, that same house is worth $900,000. Your taxes jump to $9,000. That’s a 50% increase overnight. No other state does this.

Other states that are almost as bad

California isn’t alone. Hawaii comes in second. Homes there average $1.1 million. Renters spend over 50% of their income on housing. There’s no land left to build on. Most new housing is built on former military bases or reclaimed ocean fill. Even then, construction costs are 30% higher than the mainland because everything has to be shipped in.

Oregon is quietly becoming a nightmare for buyers too. Portland’s housing market has been overheated since 2020. The city banned single-family zoning in 2021 to encourage density, but construction hasn’t kept up. In 2025, the state approved just 18,000 new units for a population growth of 45,000. Waiting lists for affordable housing now stretch over three years.

Washington State, especially the Seattle metro area, has the same problem. The tech boom didn’t just raise wages-it raised prices faster than wages could catch up. Median home prices in King County hit $745,000 in 2025. Meanwhile, the average teacher in Seattle earns $68,000. That’s not a living wage in that market. It’s a financial trap.

Why buying property online doesn’t help here

You might think buying property online-viewing listings, submitting offers, doing virtual tours-would make things easier. It doesn’t. In high-pressure markets, the digital process is just faster. You’re not avoiding the problems. You’re racing through them.

In California, a well-priced home in a decent neighborhood can get 15 offers in the first 24 hours. Online tools help you submit faster, but they don’t help you win. Sellers don’t care if you’re a first-time buyer with a 10% down payment. They want cash offers. They want buyers who can close in 10 days. They want buyers who don’t need inspections or contingencies.

And even if you win the bidding war, you still have to deal with the same local rules: HOA restrictions, seismic retrofitting requirements, water rights issues, and neighborhood covenants that ban solar panels or front-yard vegetable gardens.

What about states that are easier?

If you’re serious about buying a home without losing your sanity, look south or east. Texas, Georgia, and Tennessee have seen massive growth-but they’ve also built massive supply. In Austin, you can find a 2,000-square-foot single-family home for $420,000. In Atlanta, it’s $310,000. In Nashville, $350,000.

These states don’t have the same regulatory roadblocks. Permits take weeks, not years. Zoning is simpler. Property taxes are lower. And builders are actually making money, so they’re building more.

But here’s the catch: these markets are getting hotter. Prices are rising. You can’t assume they’ll stay affordable forever. But compared to California, they’re still a breath of fresh air.

The hidden costs no one talks about

It’s not just the mortgage. In California, you’ll pay:

- 1.25% in property taxes (on full market value)

- $200-$500 a month for earthquake insurance

- $150-$300 for HOA fees if you’re not in a single-family zone

- $100+ a month for water due to drought restrictions

- Up to $10,000 in mandatory seismic upgrades if your house was built before 1980

That’s over $1,000 a month in extra costs on top of your mortgage. In Ohio, the same house might cost $200,000-and your total monthly housing cost would be $1,100. In California, it’s $3,200.

What should you do if you want to buy?

If you’re stuck in a high-cost state and still want to buy:

- Look for smaller cities within the state. In California, that means places like Bakersfield, Redding, or Chico. Prices are 30-50% lower than in coastal metros.

- Consider manufactured homes. They’re legal in many counties and cost 60% less than traditional homes.

- Work with a local real estate agent who knows the permit process. They’ll tell you which neighborhoods have fewer restrictions.

- Don’t fall for the “I’ll wait until prices drop” myth. Prices in California have gone up every year since 1990. Waiting means paying more.

- If you can relocate, do it. The emotional cost of living in a place where housing is a constant stress isn’t worth it.

Buying a home should be exciting. It shouldn’t feel like a battle you’re doomed to lose. The most difficult state to live in isn’t just about money. It’s about time, control, and dignity. If you’re spending every waking hour just trying to afford a roof over your head, you’re not living-you’re surviving.

Is California really the hardest state to buy a home in?

Yes, for most buyers. California has the highest median home price, the lowest housing supply relative to population growth, the most complex permitting system, and the steepest property tax reset on purchase. While Hawaii has higher prices, California affects more people due to its size and population. It’s the most widespread housing crisis in the U.S.

Can you buy property online in California and avoid the problems?

No. Online buying tools make the process faster, but they don’t change the underlying issues: lack of inventory, fierce competition, strict regulations, and high costs. You’re still competing against cash buyers and investors. The digital interface doesn’t make the market fairer-it just makes it more efficient at pushing out ordinary buyers.

What’s the cheapest place to live in California if you must stay?

Eastern and Central California towns like Bakersfield, Redding, and Chico offer the best value. Homes there average $400,000-$500,000, compared to $900,000+ in the Bay Area. These areas still have decent schools, lower HOA fees, and fewer regulatory hurdles. You’ll still pay more than in most other states, but it’s the best option if you need to stay in California.

Why are property taxes so high when you buy in California?

Proposition 13 caps annual increases at 2%-but only for the original owner. When you buy a home, your property tax assessment resets to the current market value. So if a house sold for $600,000 in 2020 and now sells for $900,000, your taxes jump from $6,000 to $9,000 per year. This creates a massive financial shock for new buyers.

Should I move to a cheaper state to buy a home?

If your goal is to own a home without financial stress, yes. States like Texas, Georgia, Tennessee, and Ohio have lower prices, faster permitting, and more housing supply. You’ll trade some job opportunities or climate for affordability-and for most people, that’s a fair trade. The emotional and financial toll of living in a housing crisis is real and long-lasting.