Real Estate Firm Comparison Tool

Compare the Big 4 Real Estate Firms

Select your property characteristics to see which firm is best suited for your transaction. Based on the article content, these firms dominate large-scale commercial transactions over $20 million.

Property Value

Asset Type

Target Buyers

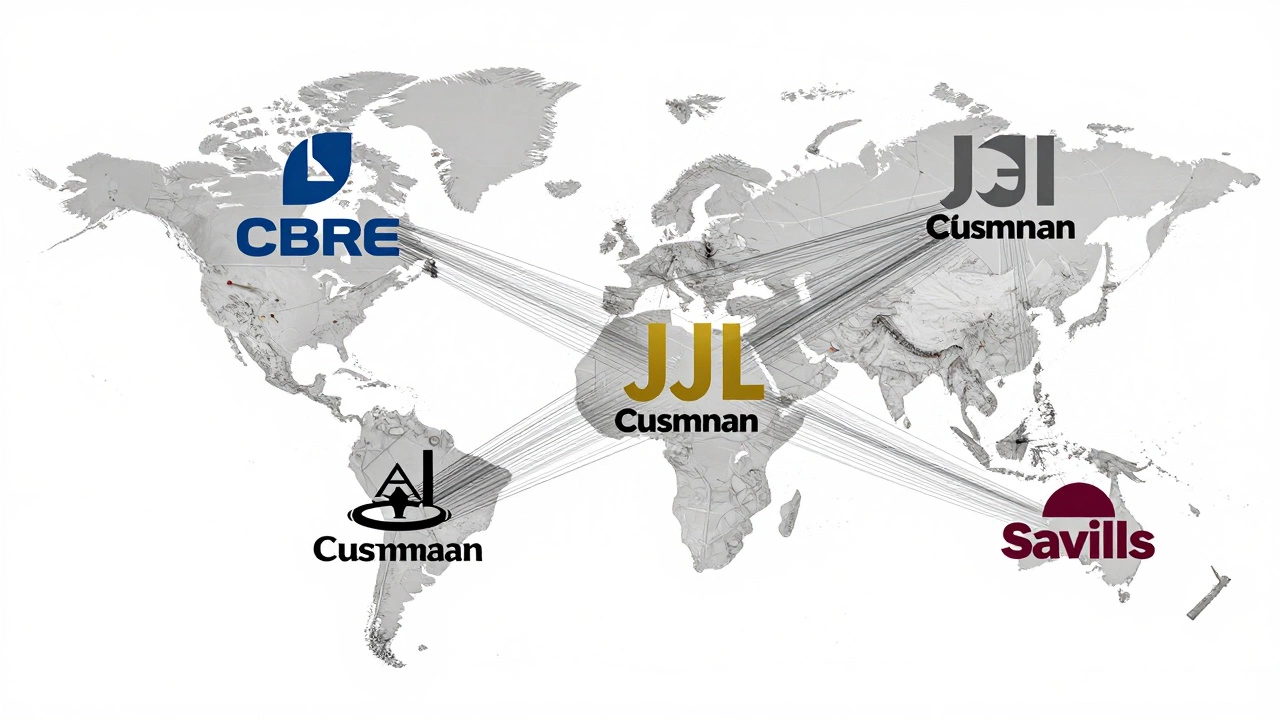

When you're selling a high-value office building, a shopping mall, or a logistics hub, you don’t just pick any real estate agent. You go to one of the four giants that control the global commercial property market. These are the Big 4 in real estate - the firms that handle the biggest deals, move the most capital, and set the standards for how commercial property is valued, marketed, and sold worldwide.

Who Are the Big 4 in Real Estate?

The Big 4 aren’t just big - they’re massive. Together, they manage over $5 trillion in commercial real estate assets across more than 70 countries. They don’t just list properties. They structure multi-billion-dollar transactions, advise institutional investors, run global leasing platforms, and even manage entire portfolios for pension funds and sovereign wealth funds.

Here are the four:

- CBRE - Headquartered in Los Angeles, CBRE is the largest commercial real estate services firm in the world by revenue. It handles everything from office towers in Manhattan to data centers in Singapore.

- JLL (Jones Lang LaSalle) - Based in Chicago, JLL is known for its deep expertise in capital markets and its strong presence in Asia-Pacific markets, including Sydney, where it’s one of the top players in office and industrial sales.

- Cushman & Wakefield - With roots in New York and a global network built through acquisitions, this firm specializes in tenant representation and asset management for Fortune 500 companies.

- Savills - A UK-based firm with deep roots in Europe and Australia, Savills has grown into a global force by focusing on high-end commercial and luxury residential markets, including prime retail and corporate headquarters.

These firms aren’t local brokers. They operate like multinational corporations with thousands of specialists - appraisers, analysts, leasing agents, capital markets teams, and data scientists - all working under one brand.

Why Do Companies Choose the Big 4 Over Local Firms?

If you’re selling a 50,000-square-foot warehouse in Melbourne, why not go with the local agency that knows the neighborhood? Because the Big 4 offer something no local firm can match: global reach, institutional credibility, and access to international buyers.

Take a recent example: In early 2025, a logistics asset in Western Sydney sold for $280 million. The seller didn’t just list it locally. They hired JLL because the buyer was a Singaporean sovereign fund. JLL had already built relationships with that fund through deals in Kuala Lumpur, Tokyo, and Frankfurt. The local firm didn’t have that network.

The Big 4 also have proprietary data platforms. CBRE’s MarketView and JLL’s Market Intelligence tools give clients real-time insights on rental trends, vacancy rates, and investor sentiment - data that’s critical when pricing a property correctly.

They also bring capital markets teams to the table. These aren’t salespeople - they’re bankers who connect sellers with private equity firms, REITs, and institutional investors looking for long-term, stable returns. A local agent might find one buyer. The Big 4 can run a global auction with 20+ qualified bidders.

How the Big 4 Handle Commercial Property Sales

The process isn’t like selling a house. There’s no open house. No sign in the front yard. Here’s how it actually works:

- Engagement - The seller signs a mandate, usually exclusive, giving the firm the right to market the asset for 6-12 months.

- Due Diligence - The firm pulls financials, leases, building reports, zoning details, and environmental assessments. They don’t just summarize - they audit.

- Marketing Package - A professional prospectus is created with floor plans, financial models, investor letters, and market analysis. This isn’t a PDF - it’s a polished, branded document.

- Targeted Outreach - The firm reaches out to its global database of investors. For a $100M+ asset, that could mean 50+ direct contacts with funds in London, Dubai, Singapore, and New York.

- Bid Process - Interested parties submit confidential offers. The firm manages a structured auction, often with multiple rounds of bidding.

- Negotiation & Closing - Legal teams, tax advisors, and financing partners are coordinated. The entire process can take 4-12 months.

This isn’t fast. But for assets worth tens or hundreds of millions, speed isn’t the goal - maximizing value is.

What the Big 4 Don’t Do

It’s important to understand their limits. The Big 4 aren’t suited for every transaction.

They rarely handle small retail strips under $10 million. They don’t do residential subdivisions. They don’t help first-time investors buy a single office suite. Their fees are high - typically 2-4% of the sale price - so they only take on deals where the commission justifies the effort.

If you’re selling a 10-unit office building in a regional Australian town, you’re better off with a local specialist who knows the area, has built relationships with regional buyers, and can move faster with lower overhead.

The Big 4 are for institutional-grade assets. Think: Class A offices, industrial parks with 10+ tenants, mixed-use developments, and major retail centers.

How the Big 4 Compare

Not all four are the same. Each has strengths based on geography, sector focus, and client type.

| Firm | Global Revenue (2024) | Strongest Markets | Specialization | Client Focus |

|---|---|---|---|---|

| CBRE | $28.3 billion | North America, Asia-Pacific | Industrial, Data Centers, Office | Institutional investors, corporations |

| JLL | $22.1 billion | Europe, Asia-Pacific, U.S. | Capital Markets, Asset Management | Real estate funds, pension funds |

| Cushman & Wakefield | $20.7 billion | North America, U.K., Middle East | Tenant Representation, Corporate Services | Corporate tenants, landlords |

| Savills | $9.8 billion | Europe, Australia, U.K. | High-end Office, Retail, Luxury | Private wealth, family offices |

Savills, for example, has a stronger presence in Australia’s prime retail and corporate HQ markets than CBRE, despite CBRE’s overall size. Meanwhile, JLL dominates in industrial logistics - a hot sector since 2020 - because of its early investments in data analytics for supply chain real estate.

Is the Big 4 Model Changing?

Yes. The dominance of the Big 4 is being challenged.

Independent firms like Colliers and Lee & Associates are gaining traction by offering more personalized service and lower fees. Tech platforms like Reonomy and CoStar are giving buyers direct access to property data - reducing the need for intermediaries.

Also, private equity firms are now buying commercial properties directly from owners, bypassing brokers entirely. In 2024, over 15% of major commercial sales in Australia happened without a broker, up from 5% in 2020.

But for now, the Big 4 still control the flow of capital. They have the relationships, the data, and the global infrastructure that no startup can replicate.

When Should You Use the Big 4?

Ask yourself these three questions:

- Is your property worth more than $20 million?

- Are you targeting international or institutional buyers?

- Do you need detailed market analysis, not just a listing?

If you answered yes to all three, then the Big 4 are worth the cost. They’ll get you the best price - and protect you from undervaluing your asset.

If your asset is under $10 million, or you’re selling to a local buyer you already know, a smaller firm will save you money and move faster.

There’s no shame in choosing the right tool for the job. The Big 4 aren’t for everyone - but when you’re dealing with serious money, they’re still the only game in town.

Are the Big 4 the only firms that handle large commercial property sales?

No, but they dominate the market for assets over $20 million. Firms like Colliers, Lee & Associates, and regional leaders like Knight Frank or Grosvenor also handle large deals, especially in niche sectors or local markets. However, the Big 4 have the global networks, institutional client lists, and capital markets teams that make them the go-to for cross-border transactions and complex sales.

Do the Big 4 charge higher fees than local agents?

Yes, typically 2-4% of the sale price, compared to 1-2% for local firms. But that fee covers far more than just marketing. It includes global investor outreach, detailed financial modeling, legal coordination, and access to exclusive buyer databases. For a $50 million sale, an extra 1% fee is $500,000 - but if the Big 4 secure a 5-10% higher price, that’s $2.5-5 million more in value.

Can a small firm compete with the Big 4 in commercial real estate?

Yes - but only in specific niches. Small firms often outperform the Big 4 in regional markets, for assets under $10 million, or when dealing with local buyers who trust personal relationships. Some boutique firms specialize in sectors like medical offices or self-storage, where deep local knowledge beats global reach. But for multinational deals, institutional buyers, or complex financing, the Big 4 still have the edge.

Is the Big 4 model dying because of technology?

Not yet. Platforms like CoStar and Reonomy give buyers direct access to data, and private equity firms are buying directly from owners. But the Big 4 have absorbed these tools into their own systems. They don’t just use data - they shape it. Their real advantage is relationships: decades of trust with institutional investors, lenders, and legal teams. Technology changes how deals are done, but not who controls the network.

Which of the Big 4 is best for selling property in Australia?

It depends on the asset. For industrial and logistics properties, JLL leads in Australia. For prime office and retail in Sydney and Melbourne, Savills and CBRE are strongest. Cushman & Wakefield excels in corporate tenant representation. If you’re selling to international buyers - especially from Asia or the U.S. - JLL and CBRE have the deepest networks. For family offices or private wealth clients, Savills often delivers better results.