Rule of Three Valuation Calculator

Calculate your property's estimated value using the Rule of Three shortcut and see how it compares to the cap rate valuation method.

Results will appear here after calculation

When you hear a real‑estate investor say a building is worth “three times the NOI,” they are referring to the Rule of Three is a shorthand valuation rule that multiplies a property’s Net Operating Income by three to estimate market value. It’s a quick‑and‑dirty method that’s been around for decades, especially in small‑scale commercial deals where time and data are scarce. This article breaks down exactly how the rule works, when it makes sense, and where it can lead you astray.

Why the Rule of Three Exists

Commercial real‑estate valuation can be data‑intensive. Detailed cash‑flow models require years of rent rolls, expense statements, and market forecasts. The Rule of Three offers a shortcut: it assumes a flat capitalization rate of about 33% (1 ÷ 3). In markets where cap rates hover near that level, multiplying NOI by three gives an approximate market price.

Key Concepts You Need to Know

- Net Operating Income (NOI) is the property’s gross rental income minus operating expenses, before debt service and taxes.

- Capitalization Rate (Cap Rate) expresses the investor’s required return; it’s the inverse of the multiplier used in the Rule of Three.

- Operating Expenses include property management, insurance, taxes, repairs, and utilities that are needed to keep the building running.

- Gross Rental Income is the total amount collected from tenants before any deductions.

- Market Value is the price a willing buyer would pay and a willing seller would accept in an arm’s‑length transaction.

Step‑by‑Step: Applying the Rule of Three

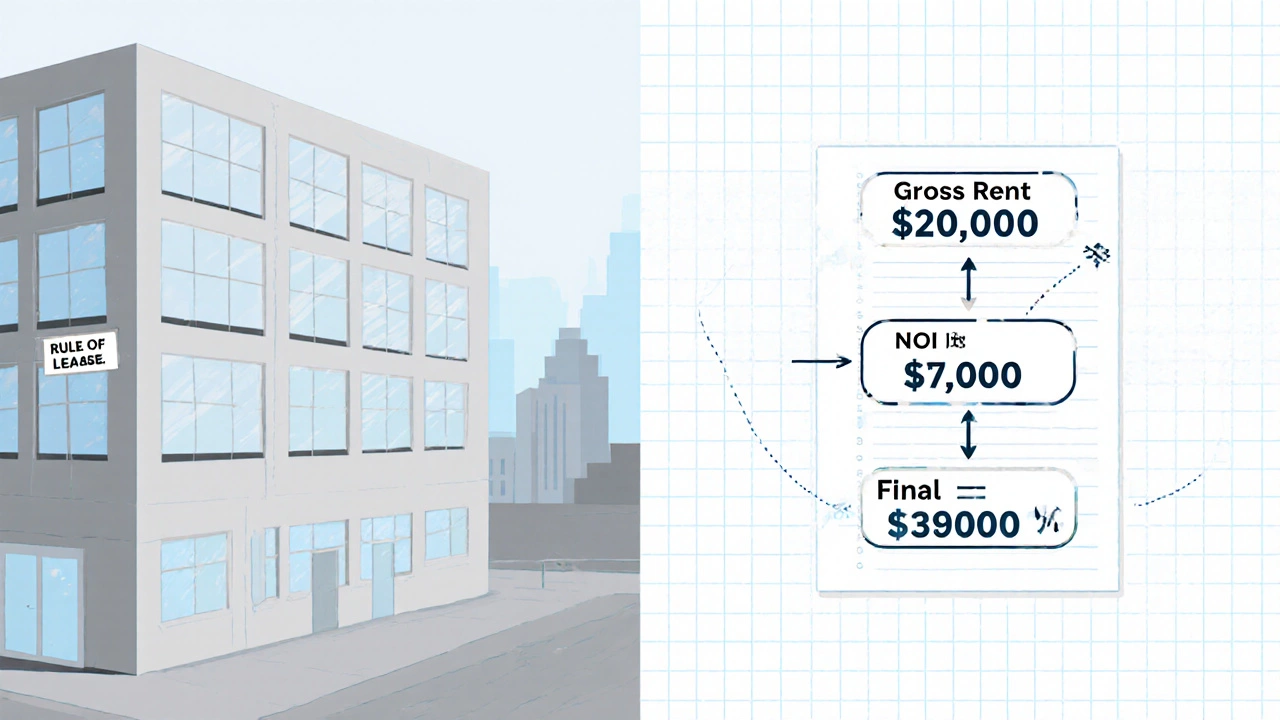

- Gather the most recent rent roll. For a 10,000sqft office building, the annual rent might be $200,000.

- Calculate operating expenses. Typical expenses are 30‑40% of gross rent; assume $70,000.

- Derive NOI: $200,000 - $70,000 = $130,000.

- Multiply NOI by three: $130,000 × 3 = $390,000. This is the Rule of Three estimate.

- Cross‑check against recent comparable sales (the “comps”). If similar properties sold for $400,000‑$420,000, the rule is in the right ballpark.

When the Rule of Three Works Well

Small‑scale investors, owner‑operators, and brokers often use the rule in three scenarios:

- Quick price screens during initial property hunting.

- Markets with historically stable cap rates around 30‑35% (e.g., certain secondary‑city office corridors).

- When detailed financial statements are unavailable, but a recent rent roll exists.

Common Pitfalls and How to Avoid Them

Relying on a single multiplier can mask important risk factors:

- Cap‑rate variance: In high‑growth cities, cap rates can drop to 5‑6%, making a three‑times multiplier wildly inaccurate.

- Expense under‑estimation: Hidden costs such as capital expenditures (roof replacement, HVAC upgrades) are not captured in the simple NOI figure.

- Lease terms: Short‑term leases or rent‑free periods inflate NOI temporarily, leading to an over‑valued price.

To mitigate these issues, supplement the Rule of Three with a brief cap‑rate check: divide NOI by the prevailing market cap rate. If the resulting value diverges significantly from the three‑times figure, dig deeper.

Alternative Valuation Methods

| Method | Data Required | Typical Use‑Case | Pros | Cons |

|---|---|---|---|---|

| Rule of Three | Recent rent roll, basic expense estimate | Initial screening, small‑scale deals | Fast, low cost | Ignores market cap‑rate shifts, capital expenditures |

| Cap‑Rate Method | NOI, market cap rate data (from comps) | Mid‑size transactions, broker valuations | Accounts for market return expectations | Requires reliable cap‑rate benchmarks |

| Discounted Cash Flow (DCF) | Projected cash flows for 5‑10 years, exit cap rate, discount rate | Large, complex assets, development projects | Captures future growth, cash‑flow timing | Time‑consuming, sensitive to assumptions |

| Comparable Sales (Comps) | Recent sale prices of similar properties | Market‑driven pricing, appraisal reports | Reflects real‑world buyer behavior | May be limited in thin markets |

Real‑World Example: A Suburban Retail Center

Imagine a 15,000sqft retail strip in a suburb of Dallas. The rent roll shows $300,000 annual gross rent. Operating expenses are $90,000 (30%).

- NOI = $300,000 - $90,000 = $210,000.

- Rule of Three value = $210,000 × 3 = $630,000.

- The local market cap rate for similar retail is 8%.

- Cap‑rate value = $210,000 ÷ 0.08 = $2,625,000.

The huge gap tells us the rule is not appropriate here. The high‑traffic retail market commands a lower cap rate, inflating the cap‑rate‑based valuation. In this case, an investor would run a DCF model or look for more granular comps before making an offer.

Quick Checklist for Using the Rule of Three

- Confirm the rent roll is up‑to‑date (within 3‑6 months).

- Verify operating expenses include taxes, insurance, maintenance, and management fees.

- Compare the three‑times result to at least three recent comps.

- Check the prevailing cap rate for the asset class and location.

- If the three‑times estimate deviates by more than 15% from the cap‑rate value, run a deeper analysis.

Frequently Asked Questions

Frequently Asked Questions

Is the Rule of Three still relevant in 2025?

Yes, but only as a rough screening tool. Modern markets have more data, so investors combine the rule with cap‑rate checks and comps to avoid costly mistakes.

What cap rate corresponds to the Rule of Three?

A three‑times multiplier implies a 33% cap rate (1 ÷ 3 = 0.33). Very few commercial markets sustain such high rates, which is why the rule is more of a shortcut than a precise metric.

Can the Rule of Three be used for industrial warehouses?

It can, but only if the local industrial cap rates are close to 30‑35%. In most major metros, industrial cap rates sit between 5‑10%, so a three‑times multiplier would vastly under‑price the asset.

How do I adjust the rule for vacant space?

Subtract the market‑rent value of the vacancy from gross rental income before calculating NOI. This gives a more realistic income figure and a tighter valuation.

What are the main alternatives to the Rule of Three?

The cap‑rate method, discounted cash‑flow (DCF) analysis, and comparable‑sales (comps) approach are the three most common alternatives. Each adds depth at the expense of time and data.

Bottom line: the Rule of Three can save you hours when you’re scouting dozens of properties, but it should never replace a thorough due‑diligence process. Use it as a first pass, then validate with cap rates, comps, or a full DCF model before signing any contracts.