Rent Tripler Calculator

Calculate Three Times Your Rent

Enter your monthly rent to see what three times that amount would be, along with budget implications.

Calculation Results

If your monthly rent is $1,500, then three times that amount is:

Triple Rent Amount:

$4,500

Budget Implications

According to the standard 30% rent-to-income rule, you would need approximately $15,000 per month in gross income to afford this rent level safely.

Additional Considerations

Don't forget to factor in:

- Utilities, internet, and insurance (~$200-$400/month)

- Other living expenses

- Emergency savings

Key Takeaways

- Multiplying rent by a factor helps you plan for larger living spaces, shared housing or future rent hikes.

- Three times $1,500 equals $4,500 - a figure you can compare against your income and other expenses.

- Use a simple formula, a spreadsheet, or a budgeting app to avoid manual errors.

- Consider utilities, internet, and insurance when you "triple" a rent amount.

- Regularly revisit the calculation as your financial situation or market rates change.

When you hear the question “What is 3 times the rent of $1500?” you’re really being asked to do a quick rent calculation. It’s a common mental shortcut for anyone juggling a lease, looking at a bigger place, or trying to gauge affordability. Below we break down the math, why it matters, and how to embed the result in a solid budget.

Rent is a recurring payment a tenant makes to a landlord for the right to occupy a property. In most Australian cities, including Sydney, rent makes up the biggest slice of a household’s monthly outflow. When you talk about $1,500, you’re usually referring to the monthly rent amount before utilities or other fees. Multiplication is the arithmetic operation that lets you scale that figure up - in this case, by three.

Understanding the Numbers

First, let’s put the $1,500 into perspective. According to the 2024 Australian Bureau of Statistics, the median weekly rent for a one‑bedroom apartment in major cities sits around $460, which translates to roughly $1,990 a month. So $1,500 is already below the median for a central location, making it a target for many renters.

If you’re thinking about a shared house, a larger apartment, or simply want a buffer for potential rent increases, you might ask yourself, “What if my rent jumps to three times its current amount?” That’s where the calculation comes in.

Why Multiply Rent Matters

Tripling a rent figure isn’t just a math exercise - it’s a planning tool. Here are three real‑world reasons people use it:

- Roommate scenarios: Adding two roommates can effectively triple the total rent you’re responsible for, even though each person pays a third.

- Future‑proofing: Landlords often raise rent by 3‑5% annually. Multiplying the current rent by three gives a quick “worst‑case” ceiling to test against your income.

- Upsizing: Moving from a studio to a three‑bedroom house often costs roughly three times more, depending on the market.

Step‑by‑Step Rent Calculation

- Identify the base rent. In this case, it’s $1,500 per month.

- Choose the multiplier. Here, the multiplier is 3.

- Apply the formula:

Result = Base Rent × Multiplier. - Do the math: $1,500 × 3 = $4,500.

- Round if needed. Since we’re dealing with whole dollars, $4,500 stays as is.

That’s it - you now know that three times $1,500 equals $4,500 per month.

Real‑World Scenarios

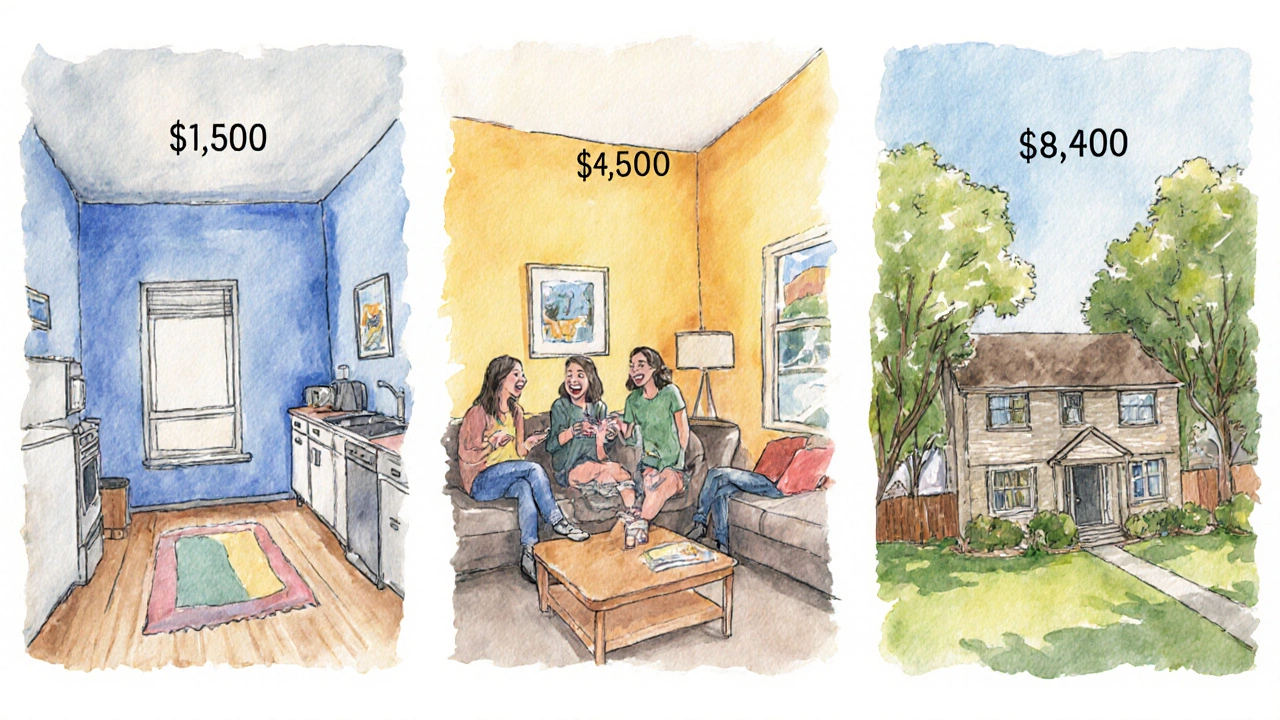

| Scenario | Monthly Rent ($) | Three‑Times Rent ($) | Typical Income Required* ($) |

|---|---|---|---|

| Solo studio | 1,500 | 4,500 | ~7,500 |

| 2‑bedroom sharing (each pays 1/3) | 1,500 | 4,500 | ~8,000 (combined) |

| Family three‑bedroom | 2,800 | 8,400 | ~14,000 |

*Assumes a safe rent‑to‑income ratio of 30% - the standard used by most lenders and financial advisers.

Common Mistakes to Avoid

- Forgetting additional costs: Utilities, internet, and renters’ insurance can add $200‑$400 monthly. Add these to the $4,500 if you’re truly budgeting for a triple‑rent scenario.

- Using weekly rent instead of monthly: Some listings quote rent per week. Convert by multiplying by 4.33 (average weeks per month) before tripling.

- Assuming the multiplier stays constant: Market dynamics change; a 3× multiplier might be unrealistic in high‑growth suburbs.

Tools and Tips for Budgeting

Here are a few budgeting tools that make repeat calculations painless:

- Excel or Google Sheets: Use the formula

=1500*3and drag the cell to test other multipliers. - Mobile budgeting apps: Apps like PocketGuard or MoneyBrilliant let you set a “Rent” category and instantly see the impact of changing the amount.

- Online calculators: Simply search “rent multiplier calculator” and you’ll find free web tools that handle currency formatting for you.

Whichever method you pick, keep the calculation in a separate “what‑if” column so your primary budget stays clean.

Next Steps

Now that you have the $4,500 figure, compare it against your net monthly income. If you earn at least $15,000 before tax, the 30% rule says you’re in the safe zone. If not, consider negotiating a lower rent, finding a roommate, or moving to a suburb with a lower cost base.

Remember, the number itself is just a starting point. Real financial health comes from looking at the whole picture - income stability, emergency savings, and long‑term goals like home ownership.

Frequently Asked Questions

What does “three times the rent” actually mean?

It simply means you multiply the monthly rent figure by three. For a $1,500 rent, the result is $4,500 per month.

Should I include utilities when I triple my rent?

Yes, if you’re building a realistic budget. Utilities, internet, and insurance typically add $200‑$400 to the base rent, so add that on top of the tripled amount.

Is a 30% rent‑to‑income ratio still the rule of thumb?

Most Australian financial advisers and lenders use 30% as a safe ceiling. It ensures you have room for other expenses and savings.

How often should I revisit the triple‑rent calculation?

At least once a year or whenever you hear about a rent increase, change of job, or consider moving. Updating the figure keeps your budget accurate.

Can I use this calculation for weekly rent figures?

Convert weekly rent to monthly first (weekly×4.33) and then multiply by three. Skipping the conversion will give you a misleadingly low number.