Rental Property Profit Calculator

Calculate your real monthly profit after all expenses. Many investors think high rent equals good returns, but in reality, location and purchase price matter most.

Property Details

Expense Details

Results

There’s no magic number for how much profit you should make on a rental property. But if you’re aiming for a return that actually moves the needle on your finances, you need to know what’s realistic in today’s market. In Sydney, where rents are high but so are costs, many new investors think 10% monthly profit is normal. It’s not. And chasing it can cost you more than you make.

What Profit Actually Means in Rental Property

Profit isn’t what the tenant pays you each month. That’s gross income. Profit is what’s left after you pay everything: mortgage, property management, insurance, council rates, water, repairs, and vacancies. If you’re not counting all of it, you’re not seeing the real picture.

Take a $800,000 property in Western Sydney. You rent it for $650 a week. That’s $2,808 a month. Sounds great. But your mortgage payment is $3,200. Property management is $520. Insurance and rates add another $200. You set aside $150 for repairs. That’s $4,070 in costs. You’re $1,262 in the red every month. No profit. Just debt.

Real profit comes from cash flow - the money left after all expenses. Most successful investors in Australia aim for $200 to $800 net per month per property. Not thousands. Not even $1,000 consistently. That’s the sweet spot where the property pays for itself and still adds to your savings.

Where the Numbers Really Add Up

Let’s break it down with a working example. You buy a two-bedroom unit in Campbelltown for $650,000. You put down 20%, so your loan is $520,000. Interest rate is 6.2%. Your monthly mortgage payment is $3,180. Rent is $580 a week - $2,519 a month. Property management is 8% of rent: $202. Council rates: $80. Water: $40. Insurance: $50. Vacancy buffer: $150 (you expect one month off every 12 months). Repairs: $100.

Add it up: $3,180 + $202 + $80 + $40 + $50 + $150 + $100 = $3,802. Rent is $2,519. You’re $1,283 short.

Now change one thing: you buy the same unit for $520,000. Same rent. Same costs. Mortgage drops to $2,500. Now your total costs are $3,122. Rent is $2,519. Still negative. But now you’re only $603 short. That’s manageable if you have other income.

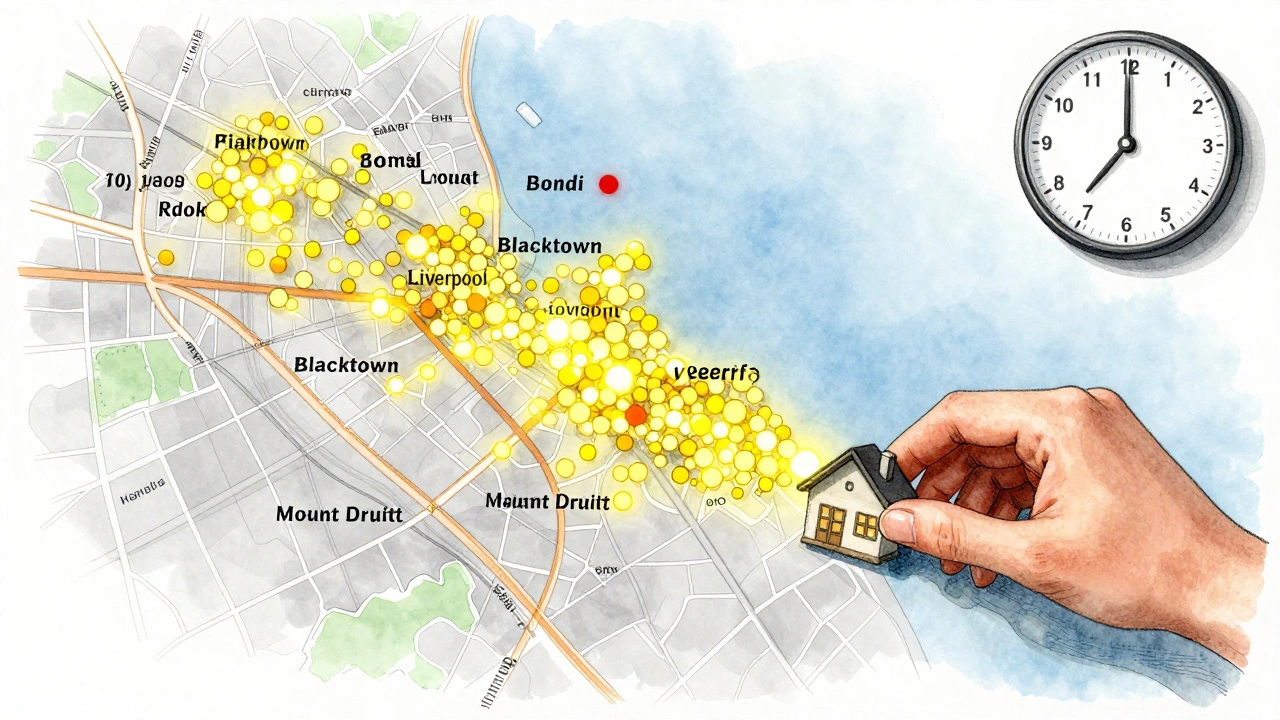

Here’s the key: profit doesn’t come from high rent. It comes from low purchase price and low debt. The best returns aren’t in the inner city. They’re in the growth corridors - places like Blacktown, Liverpool, or Mount Druitt - where you can buy for $500,000-$600,000 and still get $550-$650 a week rent.

The 1% Rule Isn’t Enough

You’ve probably heard the 1% rule: rent should be 1% of the property’s value. So a $500,000 property should rent for $5,000 a month. That’s not real. In Sydney, the average rent-to-value ratio is 0.5% to 0.7%. A $500,000 home rents for $2,500-$3,500 a month. The 1% rule is a myth from U.S. markets with lower property prices.

What you should use is the cash-on-cash return. That’s your annual net profit divided by the cash you put in. If you put $100,000 down on a property and make $4,800 net profit a year, your return is 4.8%. That’s solid. Anything under 3% is barely worth the hassle. Above 6% is excellent.

Here’s a real example: a $480,000 house in Wollongong. You pay $120,000 cash, borrow $360,000. Rent is $520 a week. Net profit after all costs: $380 a month. That’s $4,560 a year. Your cash-on-cash return: 3.8%. Not flashy, but it’s passive income that grows over time as rent increases and the mortgage shrinks.

Why Location Beats Everything

Two identical units. One in Bondi. One in Penrith. Bondi rents for $1,200 a week. Penrith rents for $650. Sounds like Bondi wins. But Bondi’s purchase price is $1.8 million. Penrith’s is $750,000.

Bondi: $1.8M property. Mortgage $1.44M at 6.2%. Payment: $8,700. Rent: $5,200. Costs: $1,500. Net: -$5,000. You’re losing money every month.

Penrith: $750,000 property. Mortgage $600,000. Payment: $3,600. Rent: $2,800. Costs: $800. Net: -$600. Still negative, but you’re only $600 short. And the property is appreciating faster because of infrastructure - new train line, hospital, schools.

Profit isn’t about rent. It’s about total return: rent + appreciation + tax benefits. A property that loses $300 a month but gains $20,000 in value in a year is a better investment than one that makes $500 profit but sits still.

What You Can Actually Expect in 2026

Based on current data from the Australian Bureau of Statistics and CoreLogic, here’s what investors are seeing in early 2026:

- Net monthly profit on a $500,000-$700,000 property in regional NSW: $100-$600

- Net monthly profit on a $800,000+ property in inner Sydney: -$200 to $200 (often negative)

- Average rental yield (gross rent / property value): 3.8% across Sydney, 4.5% in outer suburbs

- Top performing suburbs for cash flow: Mount Druitt, Liverpool, Blacktown, Campbelltown, Sutherland

Most people who make consistent profit on rentals don’t own luxury units. They own solid, functional homes in areas where demand is rising and prices are still reasonable. They don’t chase glamour. They chase numbers.

How to Boost Your Profit Without Raising Rent

You can’t raise rent every year without losing tenants. But you can cut costs.

- Switch to a low-fee property manager. Some charge 5.5% instead of 8%. That’s $100+ extra a month on a $550 rent.

- Use a specialist landlord insurance provider. Some save you 30% compared to general insurers.

- Bundle utilities. Some councils offer discounted water rates for rental properties.

- Do small repairs yourself. Replacing a tap, fixing a lock, cleaning gutters - these cost you time, not money.

- Install energy-efficient appliances. Tenants pay less on power. You get higher occupancy and fewer complaints.

One investor in Parramatta saved $1,200 a year by switching from a big agency to a local manager and installing LED lighting and a smart thermostat. That’s $100 a month extra profit. No rent increase. No tenant turnover.

When to Walk Away

If your property is consistently losing more than $500 a month, and you’re not seeing strong capital growth, it’s time to reconsider. Holding onto a money pit because you "believe in the area" is not investing. It’s gambling.

Ask yourself: Is the loss covered by my other income? If not, you’re using your salary to fund someone else’s rent. That’s not a strategy. That’s a mistake.

There’s no shame in selling a losing property. You can use the equity to buy two better ones. One bad asset can drag down your whole portfolio. Don’t let emotion hold you back.

Final Reality Check

Most people think rental property is a path to quick wealth. It’s not. It’s a slow, steady way to build wealth over 10-20 years. The best investors don’t make $5,000 a month profit. They make $300-$800 on five or six properties. That’s $1,500-$4,800 a month. And they sleep well at night because they didn’t stretch themselves thin.

Don’t chase the dream of a $2,000 profit on a single unit. Focus on buying right, keeping costs low, and holding long. Profit isn’t about how much you make in month one. It’s about how much you have after ten years.

What’s a good monthly profit on a rental property in Australia?

A good monthly profit is $200-$800 after all expenses. Many properties, especially in high-price areas like Sydney, break even or run slightly negative. Real profit comes from long-term equity growth and multiple properties, not high monthly cash flow.

Is it possible to make $2,000 profit per month from one rental property?

It’s extremely rare in Australia, especially in 2026. That would require a property worth $1.5 million+ renting for $1,800+ a week with almost no expenses. In Sydney, such a property would have a mortgage over $7,000 a month. Even luxury units rarely generate that kind of net cash flow. Focus on multiple properties instead.

Should I buy a rental property if it doesn’t make a profit right away?

Yes - if you’re getting strong capital growth and can afford the shortfall. Many investors buy properties that lose $200-$500 a month because the land is appreciating 8-10% a year. Over time, the rent catches up, the mortgage shrinks, and you end up with a paid-off asset. But only do this if your income can cover the gap.

What’s the minimum rental yield I should aim for?

Aim for a gross rental yield of at least 4%. That means if the property costs $600,000, it should rent for $2,000 a month or more. A yield below 3.5% usually means you’re overpaying. Look for properties in outer suburbs or emerging areas where yields are higher and growth is strong.

Do property management fees eat into my profit too much?

Yes - if you’re paying 8-10%. Many agencies charge that, but you can find local managers charging 5-6%. On a $600 weekly rent, that’s $72-$120 a month difference. That’s $864-$1,440 extra a year. That’s the difference between breaking even and making a small profit. Always shop around.

If you’re just starting out, don’t aim for perfection. Aim for sustainability. Buy one property that barely breaks even. Learn how it works. Then buy another. Over time, your portfolio will grow - not because you made a fortune on one house, but because you made smart, repeatable choices.