Montana Housing Affordability Calculator

Find Your Perfect Montana Home

Trying to stretch your dollar without giving up the outdoors? Montana is a sprawling western state where the price of a house can vary wildly from one valley to the next. Below you’ll discover which pockets of the Treasure State let you keep more cash in your pocket while still enjoying big‑sky living.

Quick Takeaways

- Billings, Great Falls and Livingston consistently rank as the most affordable towns.

- Median home prices under $250,000 can be found in five of the ten towns listed.

- Rent stays below $850 in the cheapest markets, well under the national average.

- Lower cost often means fewer high‑pay jobs, so weigh employment prospects with housing savings.

- Take advantage of rural property tax credits and utility subsidies where available.

How we measure "cheapest"

Affordability isn’t just about a low house price. We combine three data points:

- Median home sale price (sourced from the Montana Real Estate Board, 2024).

- Average monthly rent for a two‑bedroom unit (U.S. Census Bureau, 2024).

- Cost‑of‑living index relative to the national average (Numbeo, 2024).

Each town gets a simple score: the lower the combined number, the cheaper the overall living experience.

Cheapest towns in detail

Billings

Homebuyers love Billings because the median price sits at $219,000, while rent averages $815. The cost‑of‑living index is 92 (national = 100), meaning groceries and gas cost about 8% less than the U.S. average. The city’s 110,000‑strong population offers a decent job market in healthcare, energy, and logistics.

Great Falls

Great Falls posts a median home price of $204,000 and rents around $790. Its cost‑of‑living index of 89 makes it the second‑cheapest on the list. The city is a hub for manufacturing and the U.S. Air Force’s Air Logistics Center, providing stable employment.

Livingston

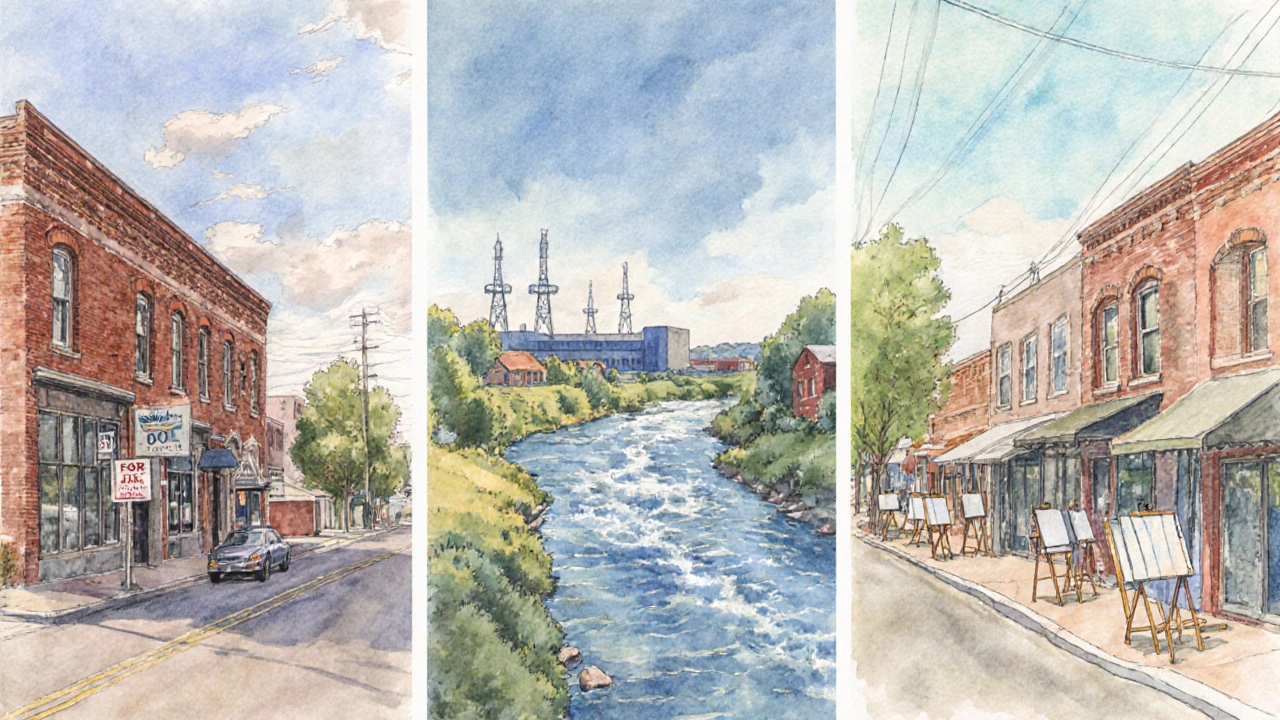

Livingston’s median home price is $231,000, rent $845, and a cost‑of‑living index of 94. While a bit pricier than Billings or Great Falls, the town scores high on quality of life-think historic downtown, access to the Yellowstone River, and a strong arts community.

Missoula

Missoula’s median home price jumps to $285,000, but rent stays reasonable at $910. The cost‑of‑living index is 98, nearly on par with the nation. The city’s university and growing tech scene offset higher housing costs for many.

Bozeman

Bozeman is the pricey outlier: median home $425,000, rent $1,150, cost‑of‑living index 108. It’s listed for completeness because many buyers eye it for remote‑work lifestyle, even if it’s not the cheapest.

Helena

Helena, the state capital, offers a median home price of $260,000 and rent $925. Its cost‑of‑living index sits at 95. Government jobs and a growing tourism sector keep the local economy steady.

Kalispell

Kalispell’s median home price is $247,000, rent $880, and a cost‑of‑living index of 96. Proximity to Flathead Lake and Glacier National Park makes it attractive for retirees and outdoor enthusiasts.

Side‑by‑side comparison

| Town | Median Home Price | Average 2‑BR Rent | Cost‑of‑Living Index | Key Industries |

|---|---|---|---|---|

| Billings | $219,000 | $815 | 92 | Energy, Healthcare, Logistics |

| Great Falls | $204,000 | $790 | 89 | Manufacturing, Military |

| Livingston | $231,000 | $845 | 94 | Tourism, Arts |

| Missoula | $285,000 | $910 | 98 | Education, Tech |

| Helena | $260,000 | $925 | 95 | Government, Tourism |

| Kalispell | $247,000 | $880 | 96 | Retail, Outdoor Services |

Tips for moving to an affordable Montana town

- Check property tax credits. Rural counties often offer reduced rates for primary residences.

- Investigate utility subsidies - many towns have lower electricity rates for residents who install solar or wind kits.

- Secure a job before you relocate. While housing is cheap, wages can be modest; sectors like healthcare, education, and government pay the most.

- Visit during the shoulder seasons (late spring or early fall). You’ll see realistic rental prices and get a feel for winter weather.

- Consider buying land and building a modest cabin. Montana’s land market still has parcels under $2,000 per acre in out‑state counties.

Common pitfalls to avoid

Even the cheapest towns have hidden costs. Keep an eye on these traps:

- Higher vehicle expenses - long distances mean more fuel, maintenance, and winter tire changes.

- Limited broadband - remote workers should verify that provider speeds meet their needs.

- Seasonal employment - many towns rely on tourism; income can dip in the off‑season.

Why the cheapest places to live in Montana still feel premium

Low prices don’t mean low quality. The towns listed combine affordable housing with access to outdoor recreation, low crime rates, and tight‑knit communities. You get a big‑sky backdrop without the big‑city price tag.

Frequently Asked Questions

What is the average cost of a home in Montana’s cheapest towns?

The median home price across the six most affordable towns ranges from $204,000 in Great Falls to $260,000 in Helena, with an overall average of about $236,000.

Do these towns have good schools?

Yes. Billings, Missoula, and Helena rank in the top half of Montana’s public‑school performance index, while smaller towns like Livingston and Great Falls maintain solid K‑12 ratings, especially for community involvement.

How does the cost of living in these towns compare to the national average?

All listed towns have a cost‑of‑living index below 100, meaning they are cheaper than the U.S. average. Great Falls (89) and Billings (92) are the most affordable.

Is broadband internet reliable in these areas?

Broadband is generally available in Billings, Great Falls, and Missoula. Smaller towns like Livingston and Kalispell may rely on satellite or fixed‑wire services, so checking provider coverage before moving is essential.

What are the best ways to find affordable land in Montana?

Start with the Montana State Land Board’s online listings, then browse county assessor sites for out‑of‑state parcels. Working with a local realtor who knows tax‑credit programs can also uncover hidden deals.