Real Estate Advice: Smart Tips for Buyers, Renters, and Investors

When it comes to real estate advice, practical guidance that helps people make smarter property decisions. It’s not about fancy jargon or sales pitches—it’s about knowing what to look for, what to avoid, and how to protect your money. Whether you’re buying your first home, renting an apartment, or looking to invest, good advice cuts through the noise and gives you real answers.

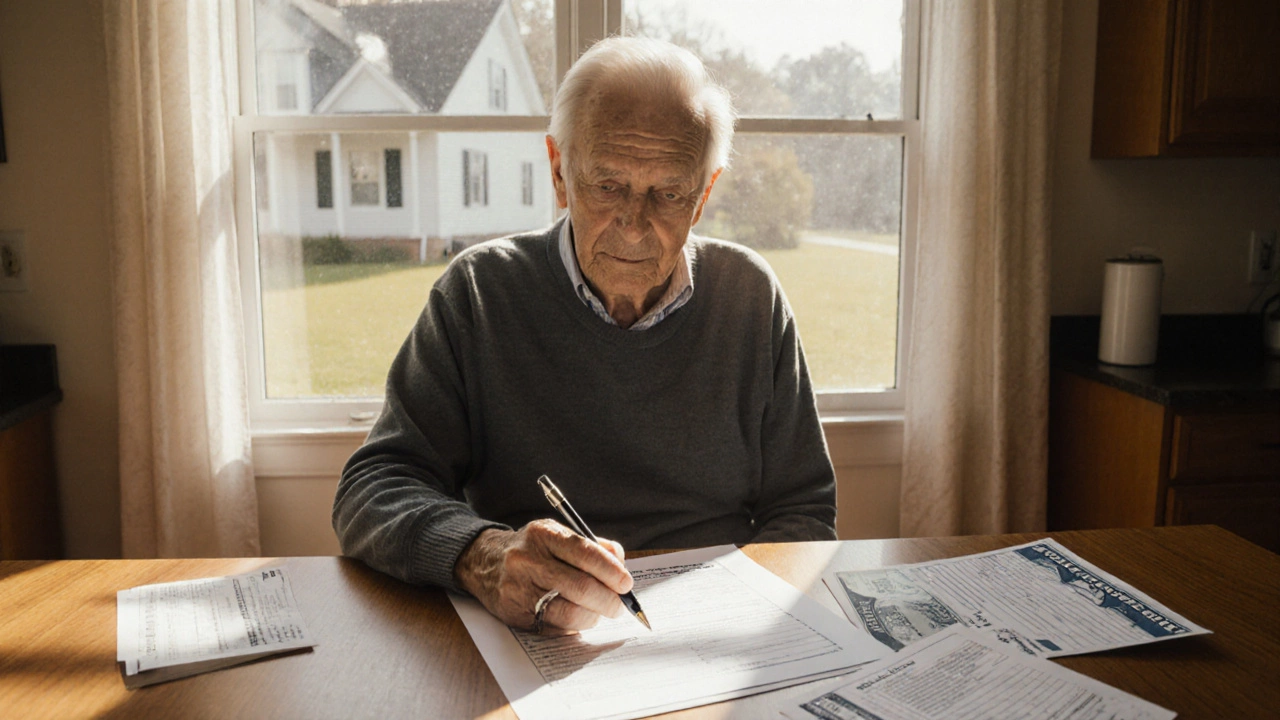

One big thing people get wrong is property tax exemption, a legal way for seniors and disabled homeowners to reduce or pause property tax bills. Many think taxes stop at 65, but that’s not true anywhere in the U.S.—including Virginia. Instead, you qualify for relief based on income, age, or disability. The same idea applies in India: local rules vary, but there are often concessions for elderly owners. Knowing this saves thousands. Then there’s gross rent multiplier, a simple number investors use to compare rental properties fast. You don’t need an accounting degree to use it. Just divide the property price by the yearly rent. If the GRM is low, you’re likely getting a better deal. It’s not perfect, but it’s a great first filter before you dig deeper. And when you’re renting or buying a 2BHK apartment, a two-bedroom, one-hall, one-kitchen home popular in Indian cities, size matters more than you think. Too small, and you feel cramped. Too big, and you pay more for space you don’t use. For one person, 600-800 sq.ft. often hits the sweet spot—enough room to live comfortably without wasting money. Meanwhile, mortgage payments, the monthly amount you owe on a home loan. Missing even one can start a chain reaction: late fees, credit damage, even foreclosure. But most lenders will work with you if you reach out early. Know your grace period. Understand what happens after 30, 60, 90 days. A little planning stops a small slip from becoming a disaster.

Real estate advice isn’t about guessing. It’s about asking the right questions: What’s my actual monthly cost? Can I afford this if my income drops? Is the location going to hold value? These aren’t just questions for experts—they’re questions you need to answer yourself. The posts below give you straight answers to exactly these kinds of questions, drawn from real situations people face. No fluff. No hype. Just what you need to move forward with confidence.